FUELING THE GROWTH OF

AMERICA’S BUSINESSES.

LVRG offers tailored financing solutions from $10K-$10M to fuel your success. Known for our ethical, straightforward approach, we are a leading provider of small business loans, working capital financing, and cash flow solutions.

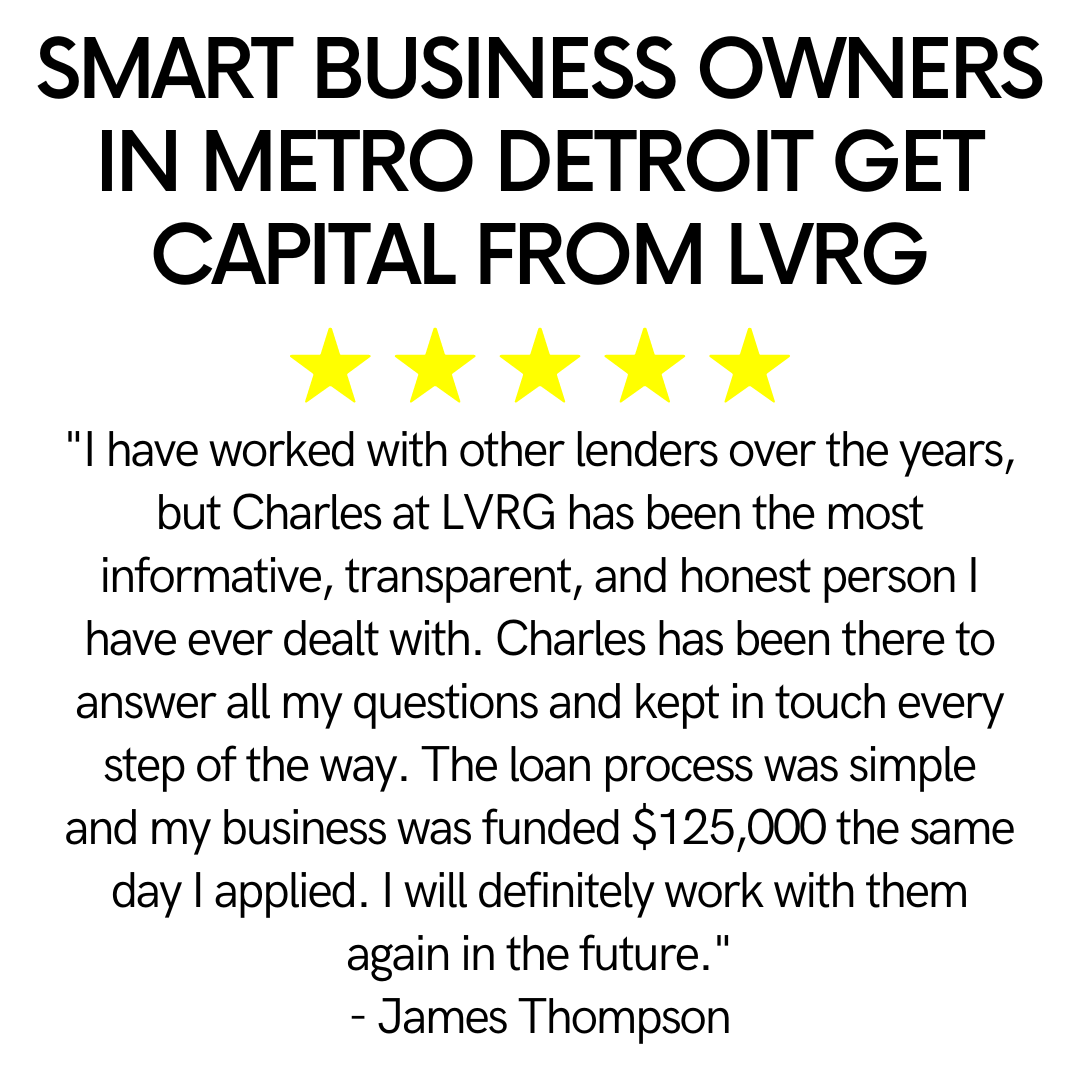

WE’RE SO PROUD OF OUR RECENT TESTIMONIALS!

FUNDED! $74K FUNDED! $3.5M FUNDED! $225K FUNDED! $1.2M FUNDED! $435K FUNDED! $2.7M FUNDED! $90K FUNDED! $560K FUNDED! $150K FUNDED! $980K FUNDED! $325K FUNDED! $1.8M FUNDED! $410K FUNDED! $2.3M FUNDED! $60K FUNDED! $640K FUNDED! $200K FUNDED! $850K FUNDED! $290K FUNDED! $1.6M FUNDED! $475K FUNDED! $2.9M FUNDED! $110K FUNDED! $530K FUNDED! $175K FUNDED! $920K FUNDED! $350K FUNDED! $1.9M FUNDED! $420K FUNDED! $2.5M FUNDED! $95K FUNDED! $1.3M FUNDED! $245K FUNDED! $1.05M FUNDED! $365K FUNDED! $2.1M FUNDED! $130K FUNDED! $610K FUNDED! $260K FUNDED! $3.2M

FUNDED! $74K FUNDED! $3.5M FUNDED! $225K FUNDED! $1.2M FUNDED! $435K FUNDED! $2.7M FUNDED! $90K FUNDED! $560K FUNDED! $150K FUNDED! $980K FUNDED! $325K FUNDED! $1.8M FUNDED! $410K FUNDED! $2.3M FUNDED! $60K FUNDED! $640K FUNDED! $200K FUNDED! $850K FUNDED! $290K FUNDED! $1.6M FUNDED! $475K FUNDED! $2.9M FUNDED! $110K FUNDED! $530K FUNDED! $175K FUNDED! $920K FUNDED! $350K FUNDED! $1.9M FUNDED! $420K FUNDED! $2.5M FUNDED! $95K FUNDED! $1.3M FUNDED! $245K FUNDED! $1.05M FUNDED! $365K FUNDED! $2.1M FUNDED! $130K FUNDED! $610K FUNDED! $260K FUNDED! $3.2M

WE EXIST TO HELP SMALL BUSINESSES SUCCEED!

WHEN IT COMES TO LENDING, LVRG MEANS BUSINESS.

Why choose LVRG? With over two decades of experience in financing small businesses, it's clear we've mastered our craft. Throughout the years, we've successfully provided financial support to over 10,000 businesses nationwide, distributing hundreds of millions of dollars. Our commitment to integrity, professionalism, and ethics stands us apart in a densely populated lending market. At LVRG, we prioritize straightforward, rapid financing solutions for your business, devoid of any marketing ploys, hidden fees, or deceptive practices. Our funding solutions range from $10,000 to $10,000,000, accommodating various lien positions without credit limitations, and offering the possibility of same-day funding.

If traditional banking institutions or other lenders have declined your application, LVRG is here to assist. We excel in addressing complex financial situations, including those involving poor credit scores or industries perceived as higher risk. Our goal is to deliver swift, intelligent financing options to growing businesses across the country. Our suite of financial services includes: cash flow financing, working capital loans, revenue based financing, merchant cash advances, SBA loans, accounts receivable factoring, inventory lines of credit, and equipment financing.

Beyond our direct in-house lending services, we leverage our extensive network of lenders, banks, and finance companies to secure the optimal funding solution tailored to your business's unique needs. Our consistent five-star ratings and glowing testimonials reflect our industry-leading status. For inquiries, reach out at (855) 998-LVRG, or apply now with no fees or obligations—and no impact on your credit score. We've made accessing the essential capital for your business's growth as effortless as possible!